Jamie Dimon, the CEO of JPMorgan Chase, has issued a cautionary statement suggesting that US interest rates could soar to as high as 8%. In his annual letter to shareholders, Dimon expressed concerns over “persistent inflationary pressures” and indicated that his bank has prepared for a wide spectrum of interest rates, ranging from 2% to 8% or even higher. This warning comes amidst global efforts by central banks to combat rising prices by raising interest rates.

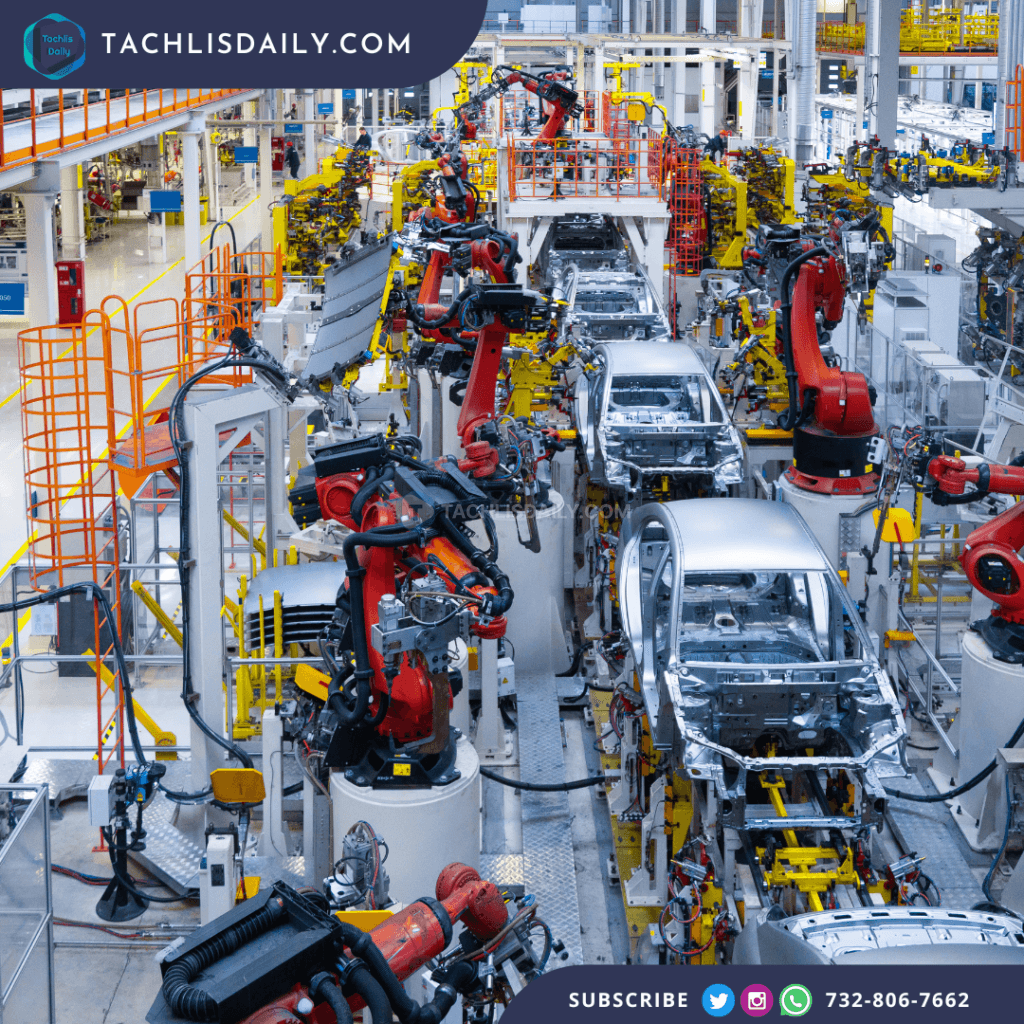

Despite the current US inflation gradually easing, Dimon believes that high government spending and the imperative to control inflation may push interest rates upward. Presently, US interest rates hover between 5.25% and 5.5%, a level not seen in over two decades. The potential surge in interest rates aims to curb borrowing for home purchases and business investments, thereby cooling the economy and mitigating inflationary pressures.

Dimon’s remarks challenge the prevailing market expectation of rate cuts, with markets anticipating two quarter-point cuts in 2024. He has consistently cautioned against overly optimistic projections of interest rate reductions, suggesting last year that rates could climb as high as 7%.

The Federal Reserve, responsible for setting US interest rates, is anticipated to make its next decision at the end of the month. While the expectation is for rates to remain steady, with potential cuts beginning as early as June, some analysts question the likelihood of rate reductions given the robustness of the US economy. Despite higher borrowing costs, the economy continues to add jobs at a rapid pace, with unemployment remaining below 4%.

Dimon’s warning underscores the pivotal moment facing the United States amid global uncertainty. As inflation figures are set to be released, the debate over interest rates intensifies, with implications not only for the US economy but also for global markets.