China has implemented sweeping new export restrictions on critical technologies used in electric vehicle (EV) battery production, intensifying the global competition over clean energy dominance and further solidifying its leadership in the EV battery supply chain.

The move places several key technologies—including those essential for lithium processing and lithium iron phosphate (LFP) battery production—under strict export control. Companies seeking to share or transfer this intellectual property outside China, whether through trade, investment, or collaboration, must now obtain a government-issued license.

This development comes amid escalating global tensions over technological sovereignty and supply chain dependencies. In recent months, China has introduced similar controls over rare earth elements and their associated magnets, materials vital to EVs, consumer electronics, and military hardware. These strategic restrictions are increasingly viewed as leverage in an evolving trade conflict with Western powers.

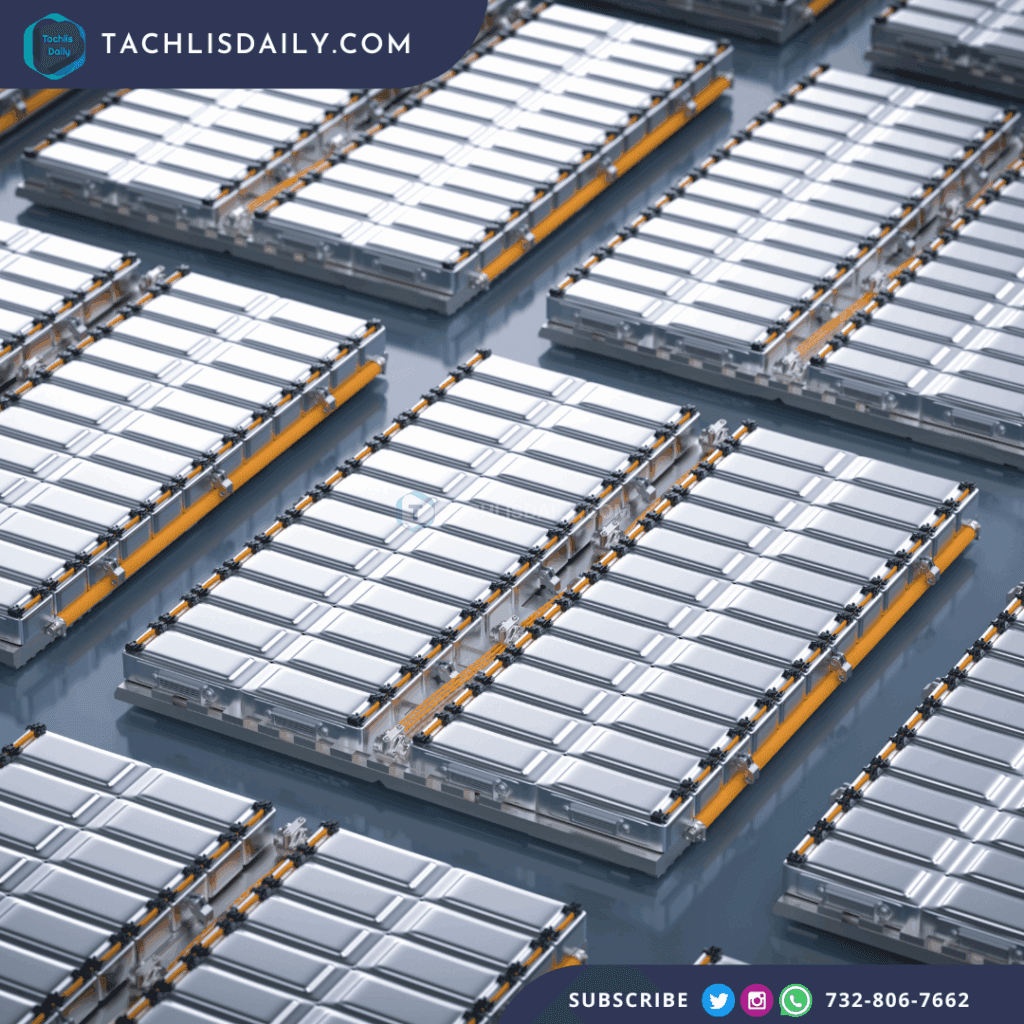

China commands a commanding position in the EV battery industry, with its companies supplying more than two-thirds of global demand. The country’s strength lies not only in battery manufacturing but in upstream processing—particularly lithium refinement and cathode material development. In 2024, China controlled 94% of LFP battery production capacity and produced 70% of the world’s processed lithium.

Analysts suggest that the new restrictions target upstream process technology, such as the production of cathodes for LFP batteries, rather than the final assembly of battery modules or cells. This distinction may limit immediate disruption to Chinese companies operating overseas, such as CATL, BYD, and Gotion, which primarily focus on cell assembly and battery pack production outside China.

Still, the licensing requirement casts uncertainty over future global expansion. Chinese battery giants like CATL—Tesla’s key supplier—have established facilities in Germany and Hungary, and have entered joint ventures in Spain and the U.S. Similarly, BYD, which surpassed Tesla in global EV sales in 2024, runs operations in Hungary, Thailand, and Brazil. Gotion also has plans for a plant in Illinois.

Experts believe the impact of the new rules will hinge on how tightly the Chinese government controls license issuance. If approvals are slow or highly selective, it could slow the globalization of Chinese battery technology and accelerate Western efforts to localize production.

The European Union and United States have already responded to China’s growing EV exports by imposing tariffs and encouraging domestic battery supply chains. Industry insiders argue that the latest move by Beijing will further motivate these regions to invest in refining capabilities and upstream material sourcing.

LFP batteries, while offering lower energy density than alternatives like nickel-manganese-cobalt (NMC) types, are valued for their lower cost, safety, and longer lifecycle. These characteristics have made them especially attractive for mass-market EVs. Though traditionally dominant in China, adoption of LFP technology is growing among Western automakers as well, particularly in the budget EV segment.

Chinese innovations in LFP are also setting performance benchmarks. BYD’s latest platform claims a 250-mile range on just a five-minute charge—far outpacing Western charging solutions. Not to be outdone, CATL has unveiled an upgraded LFP battery offering up to 320 miles with a similarly short charging time.