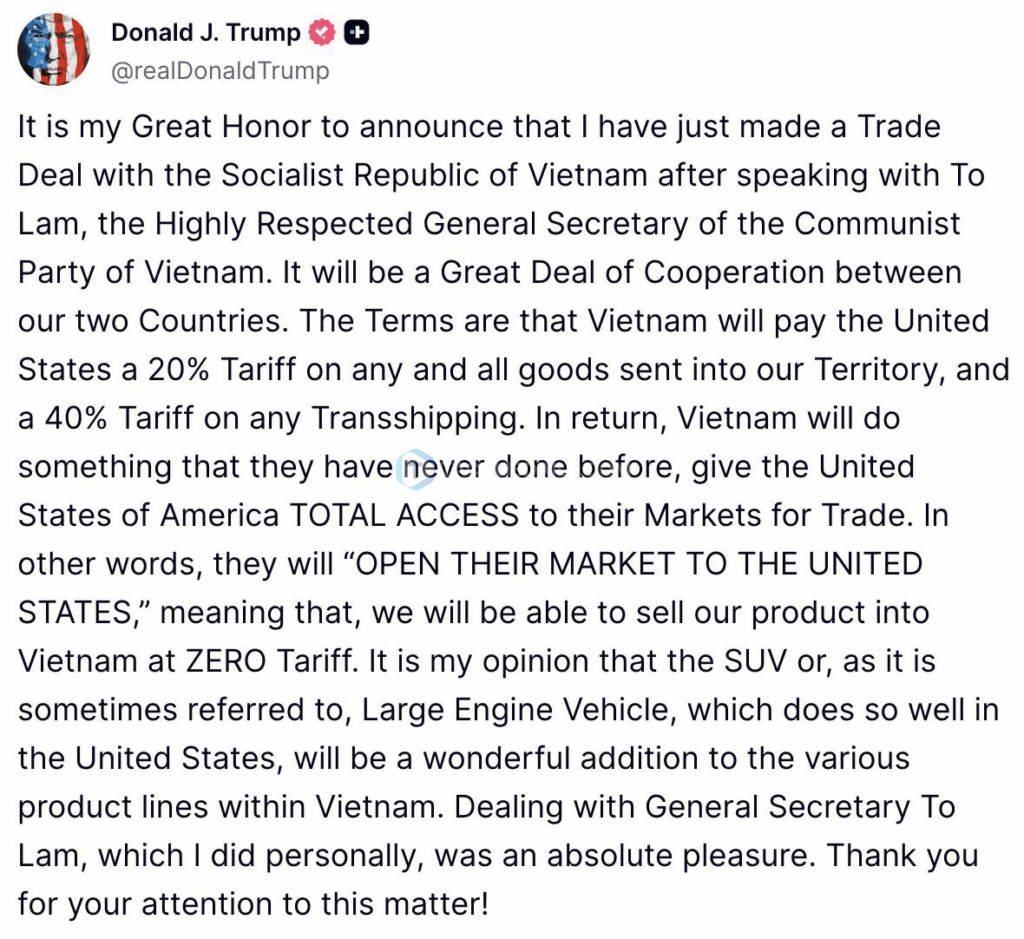

With just days left before a self-imposed deadline for sweeping new tariffs, the United States has announced a trade agreement with Vietnam that could reshape the economic relationship between the two nations. President Donald Trump declared the deal via social media, highlighting major tariff adjustments and market access promises that have stirred uncertainty across global markets and supply chains.

The agreement, described by Trump as a breakthrough, introduces a 20% tariff on Vietnamese imports to the U.S.—a significant increase from existing rates—and a steep 40% tariff on what’s described as “transshipping.” The transshipping tariff targets goods manufactured in other countries but exported through Vietnam to bypass U.S. duties. Commerce officials clarified that the higher penalty aims to prevent countries like China from funneling products through Vietnam to dodge tariffs.

In exchange, Trump claimed that Vietnam has agreed to provide the U.S. with full access to its domestic market, offering “zero tariff” conditions on American exports—something he described as unprecedented in bilateral trade history. However, details of the agreement remain unclear, and Vietnamese officials have not publicly confirmed the scope or terms of what the U.S. administration is promoting.

State-run media in Vietnam characterized the agreement as a “framework” still under negotiation, with Vietnam reportedly seeking recognition as a market economy and a rollback of restrictions on U.S. exports of advanced technology.

The timing of the announcement is strategic. A 90-day pause on reciprocal tariffs is set to expire on July 9, after which levies as high as 50% could be imposed on numerous trading partners unless new deals are reached. The Vietnam deal marks the third such agreement ahead of the deadline, as Trump seeks to use tariffs as leverage to realign America’s trade balances.

Vietnam has become an increasingly critical player in global trade with the U.S., particularly since earlier tariffs on Chinese goods pushed multinational companies to shift manufacturing operations to Vietnam. As of last year, Vietnam was the sixth-largest source of U.S. imports, totaling $137 billion—more than double its export volume from five years earlier.

This rapid expansion has also widened the trade deficit between the two nations. In 2024, the U.S. recorded a $123 billion deficit with Vietnam, making it the third-largest among all trade partners. The growing imbalance has placed Vietnam in the crosshairs of Trump’s trade strategy, which targets countries with persistent surpluses as offenders of “unfair” practices.

Industries heavily reliant on Vietnamese manufacturing—particularly apparel, electronics, and furniture—saw immediate market responses. Shares of major U.S. retailers with significant production in Vietnam surged following the announcement. Nike rose 4.2%, Columbia Sportswear climbed 1.3%, and VF Corporation gained 1.5%. Lululemon shares fluctuated but eventually rose 0.7% by mid-afternoon trading.

Wall Street responded positively, with the S&P 500 hitting a new intraday high and the Nasdaq Composite gaining 0.82%. However, the Dow Jones Industrial Average dipped slightly before recovering some losses.