General Motors has revealed that newly implemented tariffs on imported vehicles and auto parts have cost the company $1.1 billion in just the second quarter of 2025, leading to a 21% drop in its net income. The announcement underscores the mounting financial pressure that recent trade policies are placing on the U.S. auto industry.

The tariffs, which include a 25% tax on cars and components brought into the country since early April, are part of a broader protectionist economic stance aimed at reshoring production and reducing dependency on foreign manufacturing. However, the immediate impact has been steep, particularly for automakers with global supply chains.

Despite the setback, GM stated it is still on track to meet its adjusted operating income projections for the year, forecasting between $10 billion and $12.5 billion down from $14.9 billion in 2024. While the outlook remains positive, the company estimates full-year tariff costs could reach as high as $5 billion.

The company has so far refrained from passing these costs directly to consumers. It indicated that car prices are expected to rise only marginally by about 0.5% to 1% across the industry this year. This restraint has been possible largely because of a buffer: a stockpile of vehicles and parts imported before the tariffs took effect. However, as that inventory dwindles, cost pressures may rise further in the coming months.

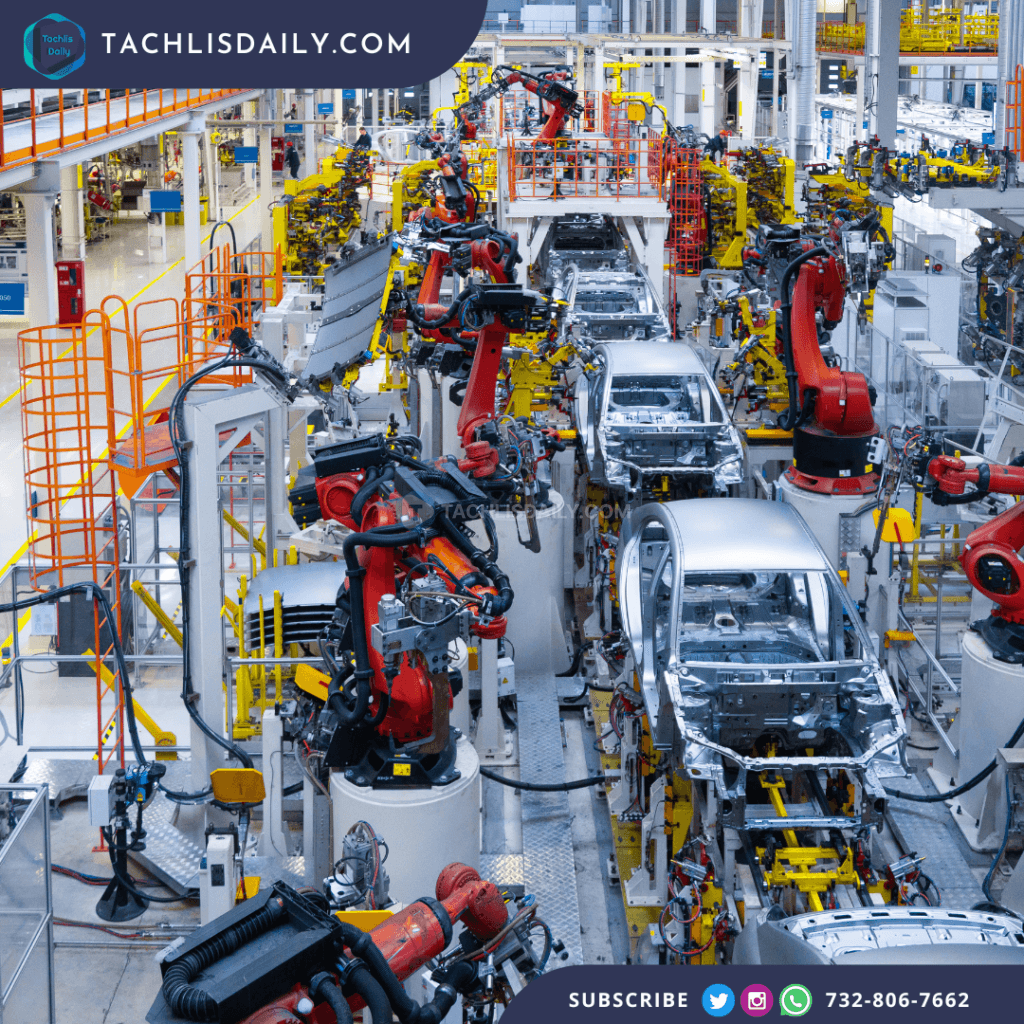

GM manufactures a significant portion of its vehicles in North America outside of the United States. In 2024, nearly one million GM vehicles were produced in Canada and Mexico, accounting for about 36% of its North American output. Additionally, the company imported roughly 100,000 vehicles from South Korea for U.S. sale. Many of these vehicles—and the parts they use—are now subject to the new tariffs.

What makes the situation even more challenging is the complex nature of vehicle manufacturing in the U.S. Nearly every car built domestically still relies on imported parts—often more than 50% of the components. While some parts from Canada remain exempt, many others have been subject to their own 25% tariffs since May.

The financial pressure is not limited to GM. Rival automaker Stellantis recently reported €300 million (approximately $350 million) in tariff-related costs for the first half of 2025. That, coupled with restructuring efforts, contributed to a net loss for the company and a 10% decline in U.S. sales in the second quarter. Stellantis has also reduced imports of some of its brands including Fiat and Alfa Romeo and temporarily paused production on select models due to the increased costs.