Copper markets were thrown into turmoil this week as prices surged to a record high following the announcement of a 50% tariff on copper imports by the U.S. government. The unprecedented move is part of a broader effort to revitalize domestic production of the critical industrial metal, which plays a foundational role in infrastructure, energy, and technology.

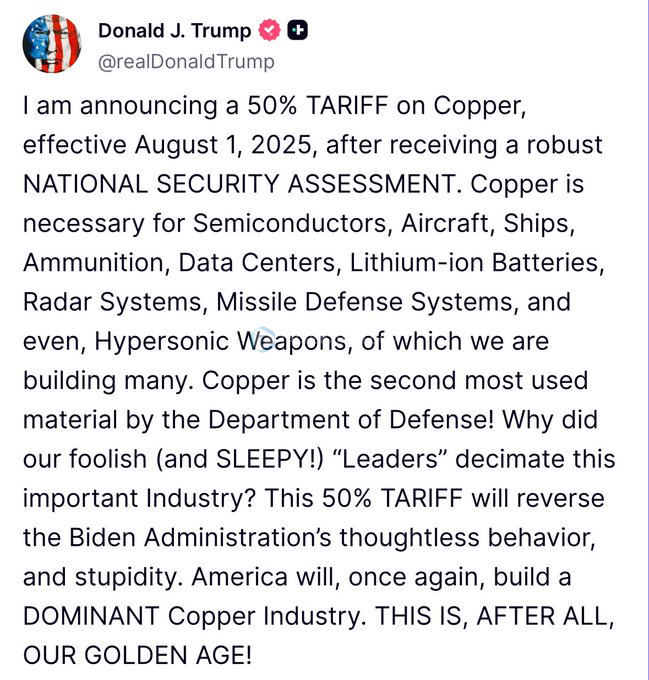

The new tariff was unveiled by the U.S. president during a Cabinet meeting, where he emphasized the importance of bolstering national supply chains for strategic resources. “Today we’re doing copper,” he stated, adding that the 50% levy would apply to copper imports, although specific countries or exemptions were not disclosed. The administration is expected to implement the tariff later this month or in early August.

Copper futures reacted swiftly and dramatically, posting a 13% gain in a single day—the largest one-day increase in the metal’s trading history. The spike comes amid already tight global supply conditions and growing demand driven by the electrification of everything from vehicles to data centers powered by artificial intelligence.

Analysts have long warned that copper is facing a structural shortage. With rising electricity consumption and technological advancement, copper has become even more essential due to its superior conductivity and durability. One analyst noted that the tariff news served as a “shock to the system” that pushed prices to levels necessary to incentivize new investment and production.

The recent rally brings copper’s 2025 price gain to over 37%, including a 29% increase in just the past six months. Domestic copper prices have now climbed to a 25% premium compared to global benchmarks, such as the London Metal Exchange, signaling acute supply pressure and investor anticipation of further disruptions.

Industry experts say this policy shift could have ripple effects across key sectors. Construction, equipment manufacturing, electric vehicles, and consumer electronics all rely heavily on copper. The resulting price inflation may impact project costs, manufacturing margins, and even broader economic indicators like the Consumer Price Index.

Financial strategists have warned that the surprise nature of the tariff announcement may cause further market instability. Investors had reportedly been expecting a far lower import duty, and many were caught off guard by the scale of the administration’s intervention.

This development also raises geopolitical concerns, as it could provoke responses from copper-exporting nations and potentially complicate existing trade agreements. However, supporters of the tariff argue that strengthening domestic copper production is crucial for national security and economic independence, especially as competition over critical minerals intensifies globally.

Meanwhile, major U.S. copper producers are expected to benefit from the tariff, which may boost investment in domestic mining operations. Sites such as the Kennecott Copper Mine in Utah could play an increasingly vital role in meeting domestic demand.